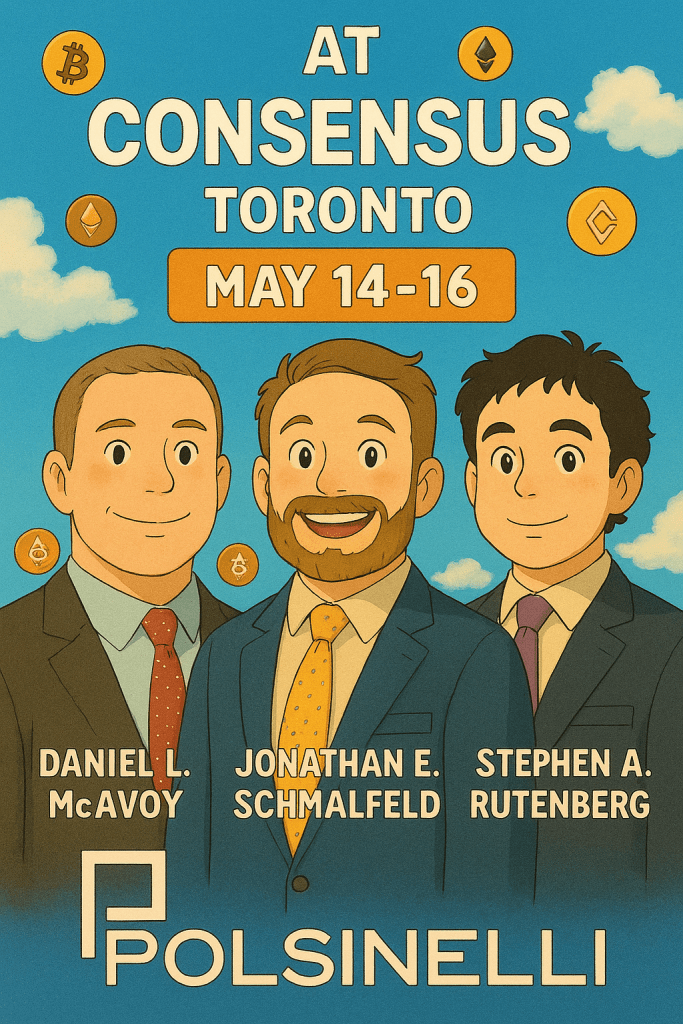

It’s Consensus week! I am going with some Polsinelli collogues, so if you are at the conference let us know and we are happy to meet up in person. In crypto news, to say it was a busy week would be an understatement. The new digital asset market structure bill had its draft language released, while at the same time a planned joint committee hearing in the House of Representatives regarding digital assets was abruptly cancelled after certain committee members expressed concern over President Trump’s involvement in the industry. A vote on the stablecoin bill in the Senate was also punted on for seemingly similar reasons. And somehow in all this chaos crypto prices had significant gains across the board.

Here’s everything that happened last week in Web3 legal:

Market Structure 2.0 Initial Draft Released

The currently unnamed bill that replaces FIT21 as the attempt at overall market structure regulation for digital assets was released last week. This largely follows the same format, with some important changes which are largely seen as improvements by the digital asset community. The main changes were regarding “decentralization” with “decentralized systems” replaced with “mature blockchain system” and shifting when a blockchain is considered decentralized/mature to a focus on whether that blockchain is or can be controlled by a single entity or group of affiliated entities. There were also changes made which created a baseline that digital assets are commodities, but circularly also say they are only commodities if they are not securities (which was already the case). They also fixed language which clarified the digital assets themselves are not securities, but rather the digital assets are capable of being sold in securities transactions.

Tl;dr– Gabe Schapiro prepared a fairly detailed write up on the bill worth reading. Justin Slaughter also wrote a thread breakdown of the bill which helpfully points out that because Japan passed a digital asset market structure bill before the FTX implosion, FTX’s Japan entity was one of the few entities in that corporate umbrella which didn’t result in customer losses. Unfortunately, because we as a country split authority over financial markets between the CFTC/SEC, crypto is also going to split between the two under any bill, which will lead to massive compliance and legal costs especially to exchanges. But the bill seems well intentioned and overall and improvement over FIT21. It remains to be seen if this is passible legislation, though, in the current political environment which as explained below held up a much less controversial stablecoin bill.

Joint House Agriculture and Financial Services Committee Roundtable for Market Structure

The day after the Market Structure 2.0 draft was released, there was a joint House Agriculture and Financial Services Committee hearing which was scheduled to be held. Witnesses included industry representatives and former CFTC Chair Rostin Behnam. This ended up not being an official “hearing” since that requires unanimous consent and ranking House Financial Services Committee member Waters objected to the hearing occurring. But it continued after that objection as a “roundtable” discussion with the witnesses who traveled to D.C. to speak on the issues. Meanwhile, the individuals opposed to the hearing taking place met down the hall for their own “roundtable” discussion, which largely focused on President Trump’s family’s involvement in digital assets and not a substantive discussion on how digital assets should be regulated in the United States.

Tl;dr– The average age of the Congressional members who boycotted the joint hearing to hold their own roundtable was 70.4. It is disappointing that a more complete group of committees did not meet to discuss digital asset legislative issues, but it is heartening to see crypto is becoming decreasingly partisan with the holdouts more likely to fall on generational lines rather than political divides. There does seem to be a concerted effort by opponents to digital asset legislation, though, to oppose on the basis of President Trump’s family’s involvement in the industry, the concerns for which should seemingly be dealt with by creating sound policy rather than trying to kill all legislative efforts for the industry through spite. As discussed above, common sense regulation if done right can go a long way to protecting American consumers while not inhibiting technological advancement.

Vote on GENIUS Act Stablecoin Bill Stalls in the Senate

After the tension that led to the organized walkout of the planned joint committee meeting in the House and news of key Senate Democrats backing off prior support for the bill, the Senate did not go forward with a floor vote on their version of stablecoin legislation deemed the GENIUS Act. There were a flurry of last minute meetings to get amendments to the bill needed to secure 60 votes, but the bill did not pass cloture. The bill can still come up for a full floor vote without needing to go back to committee, but is certainly a step backwards after previously passing the Senate Banking Committee with bipartisan support.

Tl;dr– There appears to be work to be done to get even relativity vanilla legislation like digital dollar regulation over the legislative hump. As always, Austin Campbell writes well on this topic. Crypto is not going away at this point, so if this bill is not passed, the only thing that will happen is people may change to non-dollar dominated stablecoins for everyday use due to having regulatory protections over those assets. Crypto will not be hurt by that, but the American dollar dominance will be. It is also unclear how failing to regulate stablecoins is the proper reaction to oppose the President’s family’s-backed stablecoin. As with market structure legislation, if there are concerns over self-dealing, regulation would seemingly be the best way to inhibit that.

OTHER STORIES

DOJ Disclosure Issues in Samourai: According to recent filings in the criminal case against the Samourai Wallet privacy preserving software creators, the DOJ failed to disclose evidence that FinCEN representatives told DOJ staff that “under FinCEN’s guidance, the Samourai Wallet app would not qualify as a ‘Money Services Business’ requiring a FinCEN license.” So now, for people keeping score at home, there are developers being prosecuted, in part, for failure to obtain licenses that the license granting agency said they did not need. Another reason to sign DeFi Education Fund’s petition to cease prosecution of software developers. Make financial privacy great again.

Stocks On Chain: Lots of updates regarding moving certain stock trading functions on-chain. Robinhood is looking to allow EU customers to trade tokenized stocks on Solana/ETH L2’s, SEC Commissioner Peirce gave a speech about allowing stocks to be issued, traded and settled on blockchains, and Compound founder’s project Superstate announced plans for bringing stocks on-chain and tradable in DeFi (MetaLex has similar plans, starting with SAFE funding with eventual equity issuance moving on-chain). Slowly, then all at once.

App Store Changes: The Apple App Store has removed certain restrictions on in-app purchases for users in the U.S. which are expected to allow applications to more easily integrate token-gating and digital asset use, which is huge news for creating crypto use cases.

Illinois BitLicense: Glad to see that the Illinois bill that would have made Illinois state exceedingly difficult to do digital asset business in (like New York currently is) is getting more negative attention. Its passage was seemingly inevitable a few weeks ago and now appears to have real opposition which is great to see.

ETH Upgrade Activated: The Pectra upgrade to the Ethereum network was deployed last week which is expected to improve staking efficiency and L2 scalability, among other things. Also allows account abstraction for user interactions without ETH in their wallets for gas. Seems like a big deal technically, which means nobody will care for ETH price action.

Code-Is-Speech: Loved this article on Daniel Bernstein. Bernstein v. DOJ delivered the most underutilized dicta in the game: “Government efforts to control encryption thus may well implicate not only the First Amendment rights of cryptographers intent on pushing the boundaries of their science, but also the constitutional rights of each of us as potential recipients of encryption’s bounty. Viewed from this perspective, the government’s efforts to retard progress in cryptography may implicate the Fourth Amendment, as well as the right to speak anonymously…”

Office of Comptroller Update: OCC regulated banks are now permitted to provide custody services for customers as well as other services such as record keeping and buying/selling those assets at the direction of the customer. Long overdue, and looking forward to seeing how banks implement this. Combined with promising statements for the Treasury Secretary, and the DeFi mullet (TradFi institution with interfaces to DeFi to generate yield for clients who can’t do so safety due to lack of tech knowledge) is coming.

Coinbase FOIA Treasure Trove: Coinbase is publicly releasing information they are obtaining through various FOIA requests. Highlights include SEC staffers commenting on stories about the Kim Kardashian crypto settlement, and the New York Attorney General’s office asking the SEC to submit an amicus brief claiming ETH was a security. The past is the past, but it goes to show how much power an agency with a political grudge can have over an industry, absent legislative prohibitions against such arbitrary actions.

More M&A Action: Coinbase has agreed to buy derivatives exchange Deribit for $2.9 billion. All these spot exchanges continue to shop around in efforts to be the one-stop-shop for all things crypto.

Hackers Got Hacked: Data breach gang LockBit got data breached. Even if they didn’t get private keys hacked so their ransom proceeds are safe, it is still funny to see.

$4 Million Wrench Attack Arrests: Florida teens were arrested a charged with holding a victim at gunpoint and driving him to the desert in a $4 million crypto heist. Just furthers the need for reliable crypto custody services because these types of crimes and risks are very real.

CONCLUSION

If you have any questions or would like me to write about anything else, let me know on Twitter (X?) or Warpcast. As always, I am an attorney, I am not your attorney. For legal advice, you should always consult (and pay for) an attorney.

Outro/Disclaimer: Since late 2022, I’ve prepared weekly updates for attorneys at my firm to stay abreast of the latest Web3 legal developments. The biggest stories are included in Bi-Weekly posts on the firm’s BitBlog, where we provide tl;dr overviews and insights into the biggest stories from the past two weeks. I post the weekly updates on my personal blog every Tuesday, where I also provide links to more obscure legal developments and otherwise discuss industry trends and stories. Please note, the views and opinions I express, both on BitBlog and my personal blog, are solely my own. They do not reflect the official stance or endorsement of my firm.